All Press Releases for September 07, 2022

FiveBy Responds to an Increasingly Volatile Regulatory Environment with Risk Assessment Services

Small and medium-sized businesses can use the FiveBy Risk Assessment Services to help conduct due diligence and make informed decisions regarding potential clients and business partners, while staying within budget.

FiveBy's ability to pierce the veil of information on entities, and their relations and operations in other countries, is impressive...Scott Richards, Joint Task Force for Anti & Counter Corruption

SEATTLE, WA, September 07, 2022 /24-7PressRelease/ -- There is an increase in the cost and complexity of adhering to anti-money laundering laws and sanctions in high-risk regions including in some lines of business.

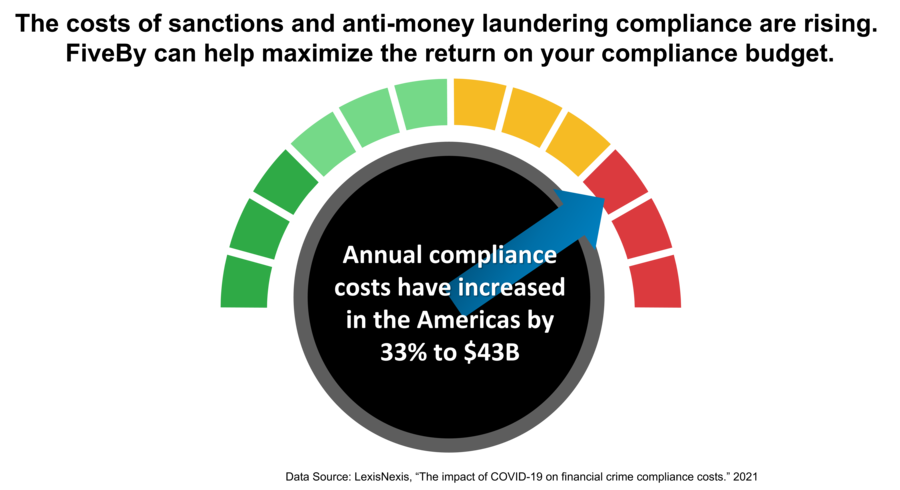

The flood of new government sanctions issued on Russia enterprises, additional sanctions on international individuals, and efforts to address money-laundering and sanctions evasion, is driving a need for more robust compliance programs. Business complexity and expenses are increasing with more rigorous government enforcement of anti-money laundering, counter financing of terrorism (AML/CFT) and sanctions regulations.

Globally, financial institutions spend more than $200 billion on compliance processes each year, according to LexisNexis* research. New technologies and managed services are often costly, and existing compliance solutions rely on technologies that can soon become outdated. FiveBy responds to these challenges with customized Risk Assessment Services.

FiveBy built its Risk Assessment Services to provide expert analysis by experienced and certified threat finance professionals, engaged on-demand and in a case-by-case basis.

The FiveBy Risk Assessment Services:

• Empower clients who may not have the resources of a larger corporation to both maintain compliance with federal policies and to improve their internal risk mitigation strategies

• Provide the "so-what" analysis that helps make sense of raw data and highlight the risks associated with a potential client or business partner

• Track regulatory, geographical sanctions, political changes, as well as the evolving money-laundering and sanctions-evasion methodologies

• Help clients protect their business from abuse by maligned actors

With assessments scaled to customer needs, the FiveBy approach offers a high-value and flexible solution for businesses of all sizes.

"FiveBy's ability to pierce the veil of information on entities, and their relations and operations in other countries, is impressive. I would not only use these services again, but I would recommend them," commented Scott Richards, Executive Director of the Joint Task Force for Anti & Counter Corruption, a global NGO.

The FiveBy Risk Assessment Services can help a business or financial institution gain valuable insights into potential clients and business partners. This is done by providing analysis to help make informed decisions about money-laundering, sanctions, geographic, and reputational risk. For more information, contact FiveBy now to discuss your risk assessment needs.

*LexisNexis Risk Solutions, True Cost of Financial Crime Compliance Study, June 2021.

FiveBy Solutions is a specialized risk intelligence consultancy with unique expertise in risk and fraud management. Companies and organizations contact FiveBy when they see risks related to fraud, abuse or compliance that could affect their reputation, their ability to support customers, their intellectual property, or their bottom line. FiveBy provides unique insight and experience to transform these risks into opportunities. Whether you work with FiveBy on an assessment, to address a one-off incident, or to create robust processes to address future risks – we will always be in your corner. We stay ahead of the game, so you don't have to.

# # #

Contact Information

FiveBy

Seattle, WA

USA

Voice: 206-800-1710

E-Mail: Email Us Here

Website: Visit Our Website

Blog: Visit Our Blog

Follow Us: