Press Releases by Industry

PRESS RELEASES BY INDUSTRY ERROR(S)

- Unfortunately, the press release you are looking for is not available. Please see below for a list of similar stories that may be of interest to you.

News Search

Energy & Oil

1371 total news stories found.

META POWER SOLUTIONS EXPANDS OPERATIONS WITH NEW LOCATION

2024-04-18 | Meta Powers Solution Opens New Location

R. Scot Buell Celebrated for Dedication to the Petroleum Industry

2024-04-10 | R. Scot Buell channels years of expertise into his work with Chevron Corporation

Spotter Global, the Leader in Compact Surveillance Radar, Launches an unprecedented 4 New Radars & 3 Radar Updates at ISC West 2024

2024-04-05 | Spotter Global's largest ever product launch will premiere at ISC West.

Marquis Who's Who Honors Robin Yochum for Expertise in the Residential Energy Industry

2024-04-04 | Robin Yochum expertly advances energy efficiency initiatives and is committed to sustainability

Williams Adeniyi Adeyemi Recognized for Outstanding Contributions to the Energy Sector

2024-04-04 | Williams Adeniyi Adeyemi's decades-long career has left a significant mark on the industry at home and abroad

Fast Guard Service: Revolutionizing Property Security for Industry Giants with Unparalleled Rapid Response Capabilities

2024-04-03 | How Fast Guard Service assist property management companies around the clock.

Spotter Global, the Leader in Compact Surveillance Radar, Announces Preview of Integrated Management Center (IMC) 2.0 at ISC West 2024

2024-04-01 | Hundreds of Sites, One Management Platform: Preview IMC 2.0 at ISC West 2024

Garzone Construction Streamlines New Construction and Builds Dream Homes in Parkland and Pompano Beach

2024-03-28 | Building Your Dream Home Made Easy: Garzone Construction Offers Custom Expertise for New Home Construction in Parkland and Pompano Beach

Pieter Wybro Lauded for Excellence in the Field of Ocean Engineering

2024-03-18 | Pieter Wybro lends years of expertise to his work with Maritech International

Jared A. Burma Recognized by Marquis Who's Who for Excellence in Waste Management

2024-02-20 | Jared A. Burma celebrates more than 10 years as an executive in the wastewater treatment industry

Jerry Bonanno has been Inducted into the Prestigious Marquis Who's Who Biographical Registry

2024-02-13 | Jerry Bonanno is recognized for his expertise as the deputy general counsel for the Nuclear Energy Institute

Tracy Air Conditioning & Heating Pros at Star Mechanical Announce Achieving 500 5 Star Reviews. To Celebrate they are Offering a $59 Air Conditioning Tune-Up

2024-02-10 | Tracy air conditioning repair, A/C installation, furnace and heating contractors at Star Mechanical has recently accomplished getting over 500 5-star reviews across multiple platforms including Google, Nextdoor, Yelp, Apple Maps and others.

Sierra Leone Flag in the Paris MoU Grey List

2024-02-06 | Sierra Leone Flag has once again been included in the Grey List of low-risk flags in the Paris MoU for years 2021-2023, which is officially expected to be announced by the Secretariat in June 2024.

George Michael Doggett has been Inducted into the Prestigious Marquis Who's Who Biographical Registry

2024-01-26 | George Michael Doggett is recognized for his expert leadership of Palladin Associates, LLC

Jonathan M. Charry, PhD, has been Inducted into the Prestigious Marquis Who's Who Biographical Registry

2024-01-12 | Dr. Jonathan M. Charry is lauded for his success in renewable energy with NewEnergy Global LLC

Magal Strengthens European Presence with Its Tarragona, Spain Office Opening

2024-01-11 | Expanding Reach and Reinforcing Commitment to the Growing Customer Base in the Region

Marquis Who's Who Includes Robert M. Quinn in Individual Profile List

2024-01-05 | Quinn is recognized for his contributions as a progressive farmer, a scientist, an entrepreneur, and an author.

Irfanul Haque has been Inducted into the Prestigious Marquis Who's Who Biographical Registry

2023-12-22 | Irfanul Haque is recognized for his expertise as a consultant with PacMarine Services, LLC

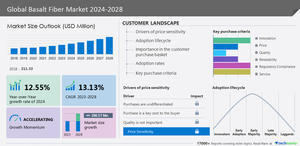

Technavio Forecasts Basalt Fiber Market Growth to Reach USD 290.57 Million between 2023-2028; Key Players Include Basalt Engineering LLC, Basalt Fiber Tech, and Others

2023-12-18 | Technological Advancements Driving Market

Technavio Forecasts Robust Growth in PMMA Market, Predicting a USD 1.79 Billion Surge by 2028 with Key Players Asahi Kasei Corp., Avient Corp., Celanese Corp., and Others Leading the charge

2023-12-18 | Strategic Insights: PMMA Industry Outlook